We are easy to find

We are located at 9520 Berger Rd, Ste. 310, Columbia, MD 21046. Our telephone number is 410-884-0317 and our fax, 410-730-3337. Our general email address is info@jkassociatestax.com.

Our office hours are generally 10 a.m. until 4 p.m. on weekdays except on Wednesdays when we are closed.

Our History

JK Associates, LLC, is a relatively new company yet it has deep roots. In the early 1990s, Jon W. Ford, CPA, began his practice in Ellicott City. From the very beginning he shared an office with a financial advisor, James Klima. Both realized the benefit of having the other in-house to answer client questions about taxes and investments.

Sadly, Jon passed away in 2010, and Karen Brelsford, a financial advisor in Jim Klima’s office and an Enrolled Agent, kept Jon’s practice going so that his clients would be served. Two of Jon’s key employees — office manager Cheryl Shea, and tax preparer/staff accountant Lori Eidsness — are still with us.

Jon Ford was passionate about serving his clients and JK Associates, LLC, strives to serve our clients in a way that would please him.

JK Associates, LLC staff

We would like to introduce you to our staff so you can picture who you are talking to and emailing. All returns are completed by Nancy Jo Lame, Ph.D, EA, CPA or Karen Brelsford, AIF, CFP®, EA, CRPS, but other staff members may help in the preparation of your return. Let’s introduce our staff:

Karen Brelsford, EA, CFP®, AIF®, CRPS®

Karen Brelsford is the owner of JK Associates, LLC as well as a financial advisor at an independent firm. She’s an Accredited Investment Fiduciary, a Certified Financial Planner practitioner, an Enrolled Agent, and a Chartered Retirement Plan Specialist. Karen focuses on individual returns and can help small business owners set up retirement plans, including SEPs and 401(k) plans. Karen dotes on four grandchildren and has tried unsuccessfully to learn to play a banjo.

Nancy Jo Lame joined us just in time for the 2013 tax season. She brings a lot of tax experience to JK Associates. She earned her Enrolled Agent license in 2011 and her CPA in 2020 and has been in the tax business since 2006. In addition to preparing taxes, she will help you deal with IRS letters you might get. If you are audited, Nancy Jo will represent you before the IRS.

When you’ve tired of talking taxes with Nancy Jo, ask her about the stars. She has a Ph. D. in astronomy from The Ohio State University. Nancy Jo is also involved in international folk dancing and is out of the office on Wednesdays so she can prepare new dances for her local folk dancing club.

And just what is an Enrolled Agent? How does it differ from a CPA?

A CPA – Certified Public Accountant – can wear many hats. A CPA can just do accounting, or perhaps specialize in taxes. Many CPAs do both, as Kathy and Keith do. Attorneys and CPAs are licensed on a state-by-state basis, and are also empowered by the Department of the Treasury to represent taxpayers before the IRS.

An Enrolled Agent is a tax specialist and a federally authorized tax practitioner empowered by the U.S. Department of the Treasury to represent taxpayers before the IRS. The EA credential is recognized across all 50 states.

Both CPAs and Enrolled Agents must complete many hours of continuing education to keep current with changing tax laws. CPAs must complete 80 hours every two years. The IRS requires Enrolled Agents to earn 72 hours — all in taxation — over three years but our Enrolled Agents belong to the National Association of Enrolled Agents which requires 30 hours of education each year. Our staff is well-schooled!

Cheryl Shea

Cheryl Shea is our office manager and our QuickBooks expert. She has been with JK and Jon Ford, CPA since 2001. She is now transitioning to retirement but still works from home many hours a day. Even though she’s not in the office, she still keeps us on track and keeps us organized. When she’s not talking taxes, she is gardening or designing jewelry.

Denita Patterson

Denita Patterson joined JK Associates, LLC, in 2011. She’s a retired government contract specialist. She puts in long hours during tax season but sometimes deserts us in early April: She plays in a huge women’s soccer tournament in Las Vegas every year. Her soccer game has even taken her to Europe.Denita, who grew up in Ohio, has a degree in construction management from the University of Cincinnati.

Sadly, Denita passed away in 2023. We are still grieving, and we just can’t take down her picture yet.

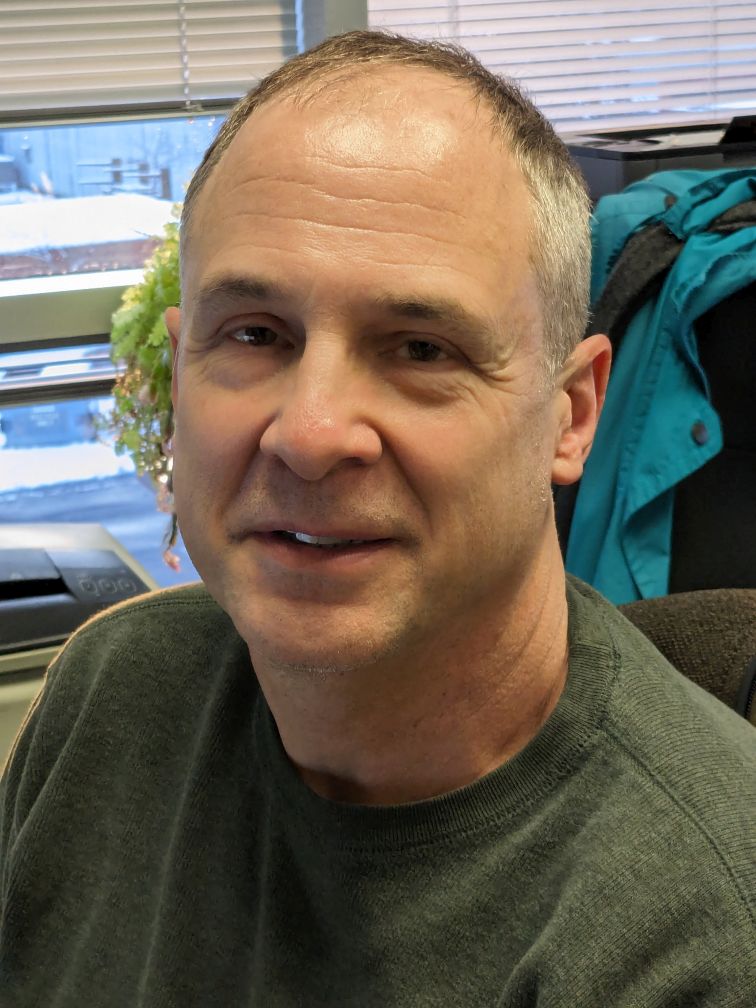

Scott Hutter

Scott Hutter has taken a circuitous path to get to JK. Born in New York, he lived in Florida for many years before moving here and joining JK in 2022. He worked for 20 years for a Tallahassee accounting firm. Scott has two bachelor’s degrees – accounting and biology – and in the Navy he served as an Electronics Technician in the Naval Nuclear Power Program.

He has two sons and is now a grandfather. If you are looking for him in the evenings or weekends, check the pickleball courts. It’s one of his passions. A hiker and traveler, he is already thinking about the next chapter in his life where he can do extensive volunteer work with animals and for the environment.

Dorothy Braunsar, CPA

Dorothy Braunsar, CPA, another retired federal employee, is with us during tax season. She loves numbers. Returns go through her hands so she can make sure the numbers add up. She’s amazing at crunching numbers and is our quality-control person. Dorothy, a fitness buff, has an undergraduate degree in business administration from LaSalle University and an MBA in Health Administration from St. Joseph’s University.

Lori Eidsness, who joined Jon Ford in 2007, is our bookkeeper/staff accountant. Lori, who also wears a tax-preparer’s hat, has a degree in finance from the University of Maryland and is a fanatic about UM’s women’s basketball team. Lori now works remotely for us after following her daughter to North Carolina.

We also have seasonal tax preparers who join us for the tax season. Tanner Cohen joined our staff in 2022.

Reach our staff by calling 410-884-0317 or emailing info@jkassociatestax.com.